Materials content material

What do you want financial institution permission for?

Mortgage nonetheless limits the liberty of motion of the house owner. What modifications and actions do you must agree along with your lender?

redevelopment

When shopping for an residence, Maria already deliberate the renovation upfront, drew up a design challenge and employed a staff. Her plans included increasing the kitchen to the territory of the loggia, however the designer warned: the credit score establishment wouldn’t permit this, as a result of. It is not only a renovation anymore.

Is it actually essential to coordinate the redevelopment with the financial institution?

Sure. The financial institution have to be knowledgeable that you just wish to radically remodel the residence: create an extra doorway or mix a toilet with a toilet.

Is it attainable to present a mortgage residence to a different particular person?

The donation of a mortgage residence to a 3rd social gathering who’s by no means linked with the principle recipient of cash is carried out based on the usual scheme.

The individuals within the transaction should agree on it, be sure that the recipient of the housing complies with the necessities of the financial institution, put together a pool of required paperwork, contact the financial institution, endure the suitable verification, contact the Rosreestr, re-register paperwork for the property.

Essential! Insurance coverage contracts additionally should be reissued to the brand new proprietor. You could must buy a brand new coverage.

To whom are you able to give?

Earlier than excited about the donation process, one thing must be executed, particularly: examine the phrases of the settlement concluded with the financial institution. Some lending establishments prescribe a clause on the prohibition of donating mortgage actual property. Whether it is current within the mortgage, then you shouldn’t depend on the consent of the creditor. Within the absence of such a ban, a couple of extra obligatory situations have to be noticed:

- The donee have to be notified of the standing of the dwelling.

- The recipient of the property is able to fulfill all obligations beneath the mortgage.

- The creditor has an curiosity in signing the deed of reward. Most frequently, banks are reluctant to take such steps, but when the proprietor not has the monetary capability to pay the mortgage, then it is going to be useful for the lender to shift the accountability to a different particular person and get their a refund together with curiosity.

The best approach is to challenge a deed of reward to a co-borrower. That is typically the partner of the borrower if the mortgage is married. However to present a completely unpaid mortgage housing to minors won’t work. Kids don’t bear monetary accountability, and due to this fact can’t be successors of collateral.

If there’s a ban on donation, this process can be attainable solely after the encumbrance is faraway from the residence, after the reimbursement of debt obligations in full.

Registration directions

The right way to challenge a donation for housing, which is in a mortgage mortgage?

To present a house to a different particular person, whether it is in a mortgage, you must undergo the next steps:

- First you must get consent from the financial institution (in writing) for the switch of property freed from cost.

- After that, the donor collects the necessary documentation and makes a donation.

- Paperwork accepted at the MFC or Rosreestre. The time period of state registration of donation of an residence on credit score can last as long as 1 month.

- The donee turns into the proprietor of a certificates of possession of a dwelling burdened with a mortgage.

The right way to challenge a donation for housing at the notary And how much will it costyou could find out on our web site.

Make a share for a partner

If the residence was bought throughout marriage, then the spouses will personal it as a part of joint, and never shared possession. You’ll be able to allocate a share to a husband or spouse even in a mortgage residence, if you happen to draw up a wedding contract or a notarial settlement on the division of property. The contract have to be registered with Rosreestr. It ought to point out what a part of the share goes to the second. As a rule, on this case, every of the spouses will get equal shares within the property.

Mortgage throughout divorce: how actual property is split

Partner / partner will be included within the composition mortgage co-borrowers or switch the standing of the title borrower from your self to your partner. All the things would require the consent of the financial institution.

Essential: the world of the share of every proprietor within the premises, based on current changes in legislationhave to be at the least 6 sq. meters. This have to be taken into consideration when allocating shares. The restriction doesn’t apply to the allocation of a share in property acquired with the assistance of maternity capital.

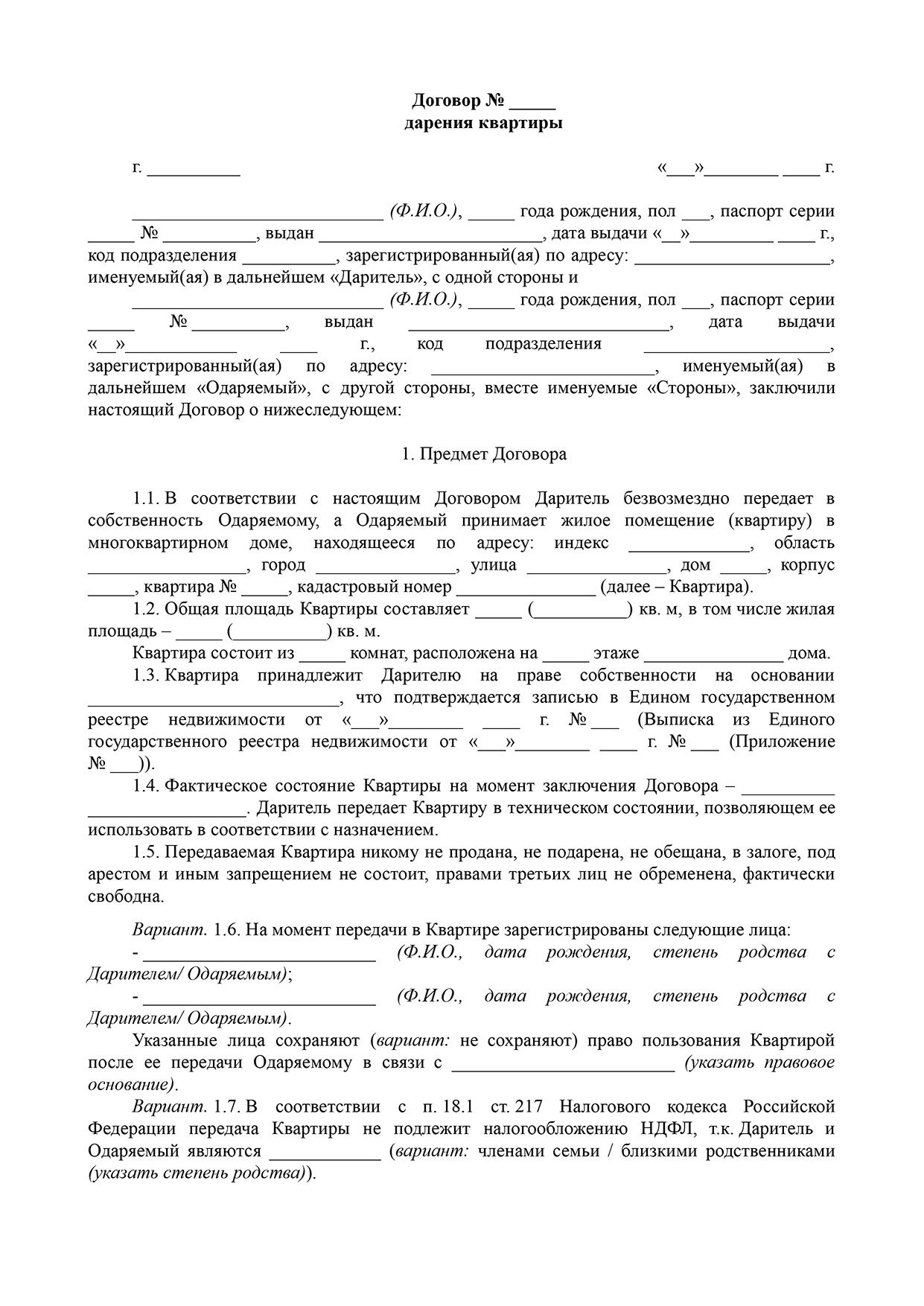

Mortgage residence donation settlement: construction

As a way to validate the contract of donation of an residence, the doc have to be drawn up accurately. We inform you write a deed of reward for a mortgage residence. The doc have to be in writing. It should include the next info:

- details about the individuals within the transaction;

- the consent of the creditor;

- technical traits of the property, its precise description;

- details about the switch of possession;

- a sign that the property is pledged to the financial institution;

- rights and obligations of the events;

- date and signatures of the events to the settlement.

Pattern software Pattern residence donation settlement

Obtain

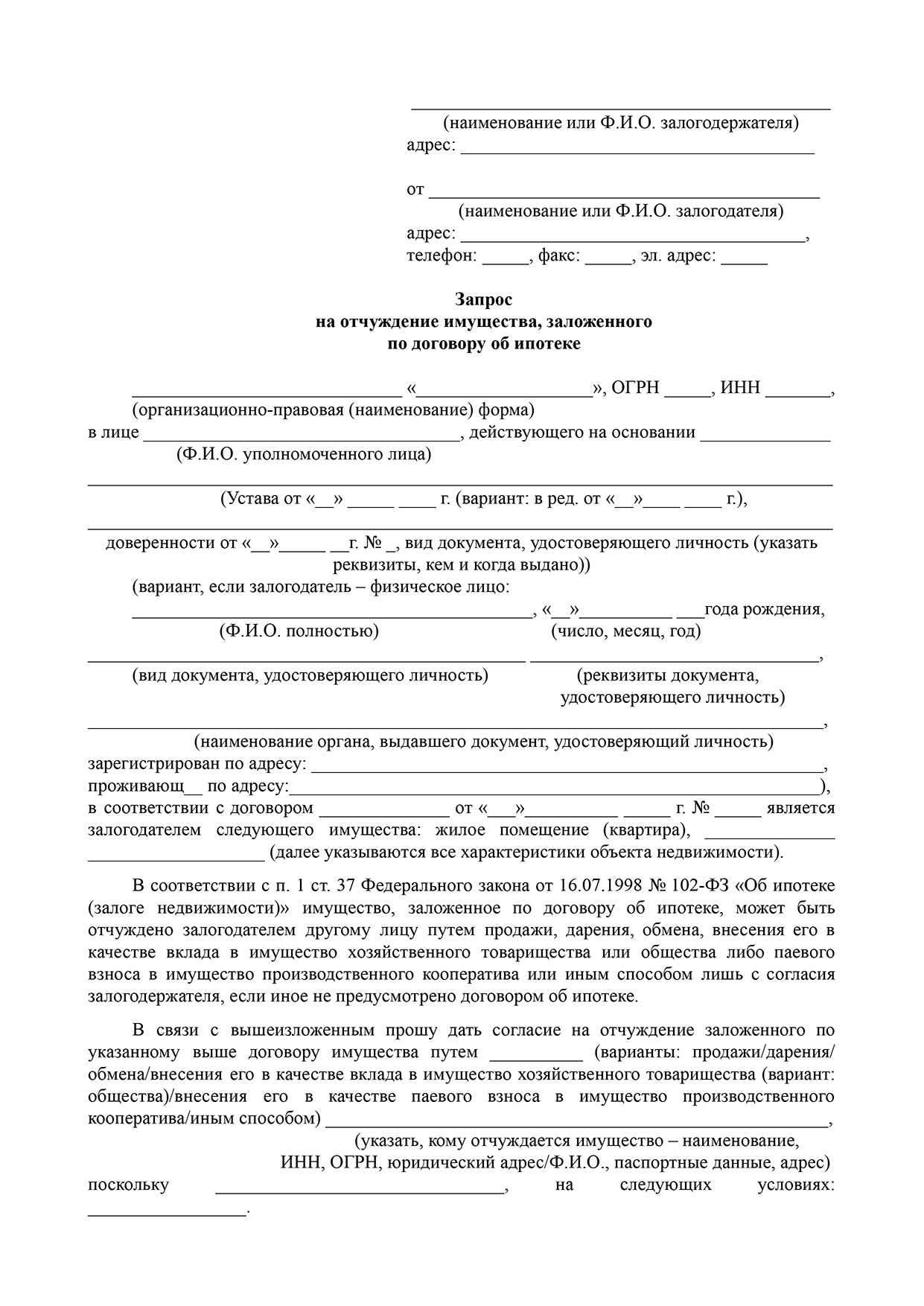

Pattern software Pattern software for permission to switch possession of an residence with an encumbrance

Obtain

Is it attainable to donate a mortgage residence with out the consent of the financial institution?

Some folks mistakenly suppose that they may give mortgage housing to somebody from their family. Nonetheless, with out the consent of the financial institution, it’s unattainable to do that.

Even when the donor and the donee conclude a donation settlement, such a doc won’t have authorized pressure, since it should then should be registered with Rosreestr, and there nobody will take the settlement with out the consent of the monetary establishment the place the borrower took the mortgage.

And even when the borrower has some connections, he in a crafty approach carried out the registration of the contract, then if this reality is found, the financial institution could demand to cancel the transaction and oblige the borrower to repay the mortgage prematurely.

If the borrower doesn’t adjust to the financial institution’s necessities, then the creditor has the suitable to demand the sale of the borrower’s collateral in court docket.

donation settlement template

Even though the deed of reward is drawn up in a easy written kind, you have to be extraordinarily cautious when compiling the textual content of the doc. You have to specify:

- details about the events (the donor, the recipient, in addition to the main points of the banking group);

- indication of acquiring consent from the creditor;

- description and technical traits of actual property;

- situations for the switch of dwelling house (irrevocably and freed from cost);

- rights and obligations of the events to the settlement;

- info on the switch of possession, indicating that the gifted particular person is knowledgeable that the obtained dwelling house is pledged to the financial institution;

- date and signatures of the events.

A sample donation agreement for a mortgage apartment can be downloaded here.

Donation of a mortgage residence

Being the unconditional property of the proprietor, an residence bought with a financial institution mortgage is collateral, as a result of offers loans. Is it attainable to donate a mortgage residence with an unpaid mortgage?

Actual property, consisting of a mortgage encumbrance, its proprietor has the suitable to donate solely with the approval of the mortgagee (legislation No. 102-FZ, artwork. 37, clause 1). A situation on the potential of transferring possession of a mortgaged residence via a donation must be included within the mortgage settlement. This may be executed even when the settlement signed with the financial institution doesn’t include a clause on the admissibility of fixing the borrower whereas sustaining the article of collateral – it’s simple to attract up an extra settlement. Nonetheless, prior approval of the donation from the mortgage financial institution is required.

If the mortgage on the residence is legitimate for lower than 10 years, if the mortgage quantity is repaid by lower than 65%, and if the particular person donated by the collateral actual property doesn’t show solvency, the chance of the financial institution refusing the donation transaction can be 99%.

Figuring out the solvency of the recipient with a mortgaged residence, the financial institution will assess the placement of a high-rise constructing with a mortgaged residence, the event of infrastructure on this space (settlement) and the present place of residence of the particular person to whom the borrower intends to donate mortgaged housing. Whether it is concluded that it’s unattainable for the donee citizen to seek out long-term employment within the settlement on the tackle of the mortgage residence, there can be no financial institution approval for the donation transaction.

Notice that the creditor financial institution will almost certainly approve the donation of a mortgaged residence if the monetary situation of the borrower has misplaced stability for goal causes (lack of working capability, sickness), and the partner or grownup (employed) kids of the borrower are probably donee, i.e. his shut family.

As for donating a share in a mortgaged residence, the credit score financial institution is assured to not approve such a transaction, since a rise within the variety of homeowners will tremendously complicate the potential of returning borrowed funds (the excellent a part of the mortgage quantity) by promoting the residence. These. the norm of the legislation on the authorized successors of the mortgagor as solidary mortgagors (legislation No. 102-FZ, artwork. 38, p. 2) applies to a better extent to inherited mortgage actual property.

The price of issuing a donation

The full price of registration of the contract depends upon the place the place the transaction passed off. When contacting personal actual property workplaces and legal professionals, it must be borne in thoughts that there isn’t any mounted price: the quantity would be the sum of the person charges of the group.

The state responsibility is 2,000 rubles, the process for transferring land is estimated at 350 to 2,000 rubles. An extract from the home guide is made freed from cost; for the data offered from the USRN, you’ll have to pay an quantity of 300 rubles.

From a monetary perspective, probably the most economical choice is to contact the MFC, and the costliest is the assistance of a notary. Nonetheless, in some circumstances, the latter choice is the one attainable and most reasonably priced.

Proprietor’s rights

The acquired property turns into the property of the customer after he:

- Signed a contract of sale with the vendor.

- Transferred the agreed sum of money to the opposite social gathering.

- Registered possession in Rosreestr.

When making use of for a mortgage, some changes are made to this process. The contract is concluded between three events – the vendor, the customer and the lender. The financial institution provides cash, due to this fact it imposes an encumbrance on the dwelling house in order that the borrower can’t eliminate the property alone.

Mortgage borrower after registration of housing has the suitable:

- To maneuver into the premises himself and to settle shut family, members of his household.

- Register in it and register family there.

- Make beauty repairs.

- Furnish the house as you would like.

Restriction of the proprietor’s rights applies to the next procedures:

- Property For Sale.

- Donation kind.

- Registration within the residence of individuals who shouldn’t have a household relationship with the proprietor.

- Finishing up transforming.

- Lengthy-term lease of premises.

Any of those actions have to be agreed with the creditor and might solely be carried out together with his approval.

Options of the donation settlement

Alexandra Voskresenskaya, lawyer at Yukov & Companions:

– Attributable to the truth that the donation settlement is a gratuitous transaction, issues could come up throughout its conclusion if the events usually are not shut family. Most often, donation agreements are disputed in the event that they have been made by individuals who usually are not formally associated (together with these in a civil marriage). On this case, the popular type of donation is a notarial one, which, in accordance with judicial observe, is rather more troublesome to problem.

Altering the phrases of the present mortgage settlement

Probably the most dependable choice is, along with the proprietor (your relative – the borrower), to contact the mortgagee (to the financial institution) with a proposal to alter (revise) the phrases of the present mortgage settlement along with her, together with you as a celebration to the settlement and a co-borrower and dividing the quantity of the mortgage debt between you .

Thus, by re-registering the credit score relationship with the mortgagee in order that additional mortgage funds are additionally partially made by you, it is possible for you to to legally make mortgage funds for this residence (share in it) and can have the ability to management the state of affairs of fulfilling obligations to the financial institution.

If the mortgage financial institution doesn’t settle for your proposals, then there’s all the time the chance to use for refinancing of the quantity of the mortgage debt to different mortgage banks. The principle factor is that you just grow to be a celebration to the mortgage settlement with the pledgee financial institution.