Materials content material

About DeltaCredit Financial institution

reference Info

Registration quantity: 3338

Date of registration by the Financial institution of Russia: 02/04/1999

BIC: 044525110

Essential state registration quantity: 1027739051988 (08/07/2002)

Approved capital: RUB 3,243,167,978

License (date of problem/final substitute) Banks with a fundamental license are banks which have a license with the phrase “fundamental” within the title. All different working banks are banks with a common license: Normal license for banking operations (21.01.2015) Licenses

Participation within the deposit insurance coverage system: Sure

DeltaCredit Financial institution was based as a extremely specialised monetary establishment again in 1999. At present, all 100% of DeltaCredit’s shares are owned by Rosbank. In response to the most recent scores, DeltaCredit ranks forty eighth within the nation by way of belongings and thirty ninth within the area. When it comes to web revenue, the offered monetary establishment occupies solely 74th place within the Russian Federation. The consumer base of DeltaCredit primarily consists of people, in addition to small company purchasers. In contrast to different monetary establishments, DeltaCredit doesn’t present providers corresponding to time period deposits, shopper loans or settlement providers. He specializes completely in mortgage lending from DeltaCredit Financial institution. The community of the represented group can be slightly poorly developed in comparison with different banks. It consists of: the primary workplace situated in Moscow; branches and credit score and money places of work of DeltaCredit Financial institution within the areas (whole variety of 19 items); 1 extra workplace. DeltaCredit doesn’t have its personal ATMs that would service the bank cards of the represented group. Holders of such playing cards can use Rosbank ATMs, the variety of which within the Russian Federation at present reaches 3 thousand items.

Ranking of banks in Russia

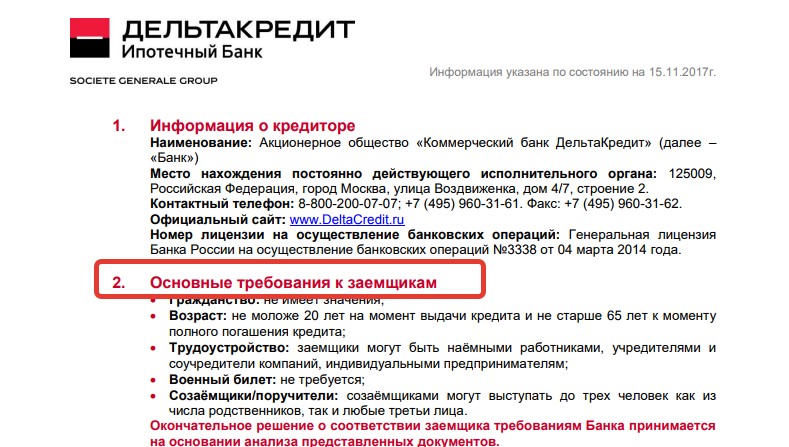

Necessities for the borrower

Earlier than taking out a mortgage from DeltaCredit Financial institution, it’s price familiarizing your self with the prevailing necessities:

- Submit all essential paperworktogether with proof of earnings.

- The borrower should be of age (not lower than 20 years outdated and no more than 65 years outdated).

- Expertise in a single place of business needs to be at the very least three months.

- You’ll want to have the suitable quantity making a down fee.

Why is a mortgage in Deltacredit Financial institution in demand?

Mortgages in Deltabank are in demand for a lot of causes.

Debtors are appropriate not just for lending circumstances, but additionally for the potential of mortgage applications which might be applied to purchase actual property on the secondary market, in cottage plots, in new buildings or on the safety of their property.

However the reputation of the financial institution is just not solely linked with this, since there are different causes:

- Favorable percentageswhich begin from 8%.

- Eat appropriate mortgage provides for homeowners of maternity capital, wage playing cards, younger households.

- You will get a mortgage on favorable phrases utilizing bonus program advantages.

- Eat handy private account on the positioning, which data all of the helpful info concerning funds, mortgage balances and fee schedules.

Associated video:

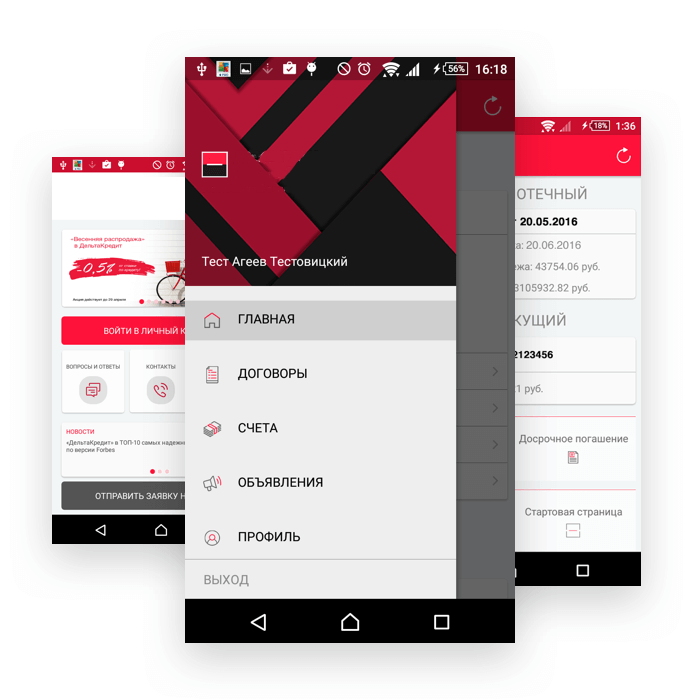

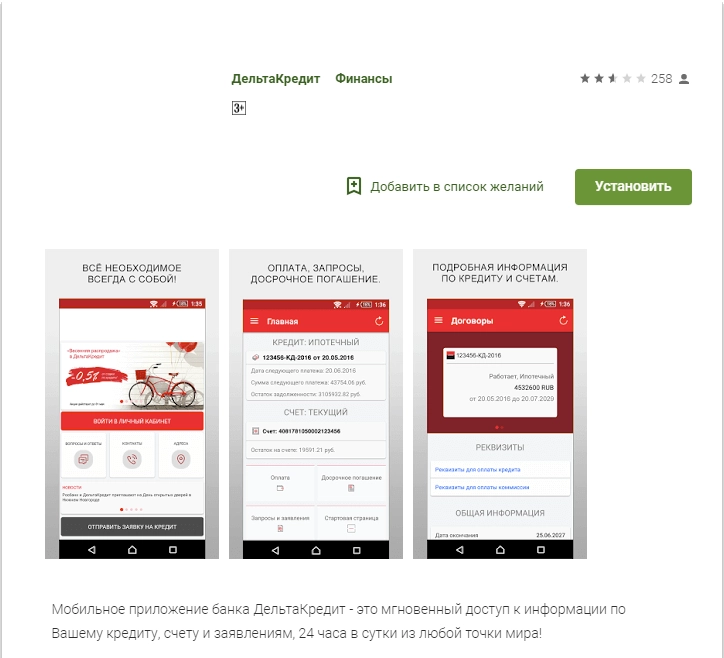

Cellular utility of Deltacredit financial institution

To achieve entry to the private account of DeltaCredit Financial institution from a smartphone, a handy cell utility is offered, which is named “DeltaCredit”. The appliance lets you carry out all the fundamental operations out there within the consumer’s private account from the display screen of your cell machine. Homeowners of cell devices primarily based on iOS and Android can set up the applying on their smartphone. Utilizing the applying (in addition to a private account) is totally free.

To enter the applying, use the login and password obtained when registering your private account. If you’re not registered, you’ll be able to register immediately within the utility.

The DeltaCredit cell utility lets you carry out the next operations:

- On-line fee for a mortgage and different providers with Visa and MasterCard financial institution playing cards

- Details about the account steadiness and the quantity of the subsequent mortgage fee

- Info on the insurance coverage contract

- The potential for early compensation of the mortgage (make it possible for the required quantity for debiting is on the account)

- Registration of requests and certificates (for instance, for property tax deduction or maternity capital)

- Calculation of the quantity of the month-to-month fee for any financial institution mortgage

- Addresses of the closest branches and ATMs

- Part “Query-Reply” (solutions to the most well-liked questions of financial institution prospects)

- Suggestions with the financial institution (particular type of contacting the financial institution)

To obtain the cell utility of the financial institution, go to the applying retailer of your machine (Google Play or App Retailer) and enter the title of the financial institution “DeltaCredit” within the search. The primary consequence ought to present the cell consumer we’d like: the company emblem and the title of the financial institution might be displayed.

Subsequent, click on the “Set up” button and look forward to the obtain to complete in your smartphone. After the obtain is full, you’ll be able to enter the applying by clicking on the icon that seems within the menu of your cell phone.

You too can obtain the official utility of DeltaCredit Financial institution by clicking on one of many hyperlinks under: