Materials content material

Checklist of accredited corporations of Sberbank for mortgage insurance coverage

Insurance coverage corporations companions of Sberbank for mortgages:

- Sberbank Insurance coverage.

- “Absolute Insurance coverage”.

- Alpha Insurance coverage.

- “Alliance”.

- “VSK”.

- Zetta Insurance coverage.

- Ingosstrakh.

- “CARDIF”.

- “BET”.

- “RESO-Assure”.

- Rosgosstrakh.

- “SOGAZ”.

- ENERGOGARANT.

Every firm that acquired the best from Sberbank to hold out mortgage insurance coverage signed a particular settlement with it. It states that she has the best to rearrange insurance coverage for the borrower, to conclude an insurance coverage contract with him. A whole record of organizations that Sberbank determined to accredit is on its web site. All of them transmit info to the financial institution in regards to the insurance coverage of their shoppers.

The record of corporations that Sberbank wished to accredit could change now and again. Insurance coverage in them is an appropriate possibility for a financial institution. Due to this fact, you could periodically verify the present info on the web site of the monetary establishment.

Checklist of accredited corporations of Sberbank

A whole record of mortgage insurers could be discovered on the web site of the credit score establishment on the hyperlink.

- Absolute Insurance coverage;

- AlfaInsurance;

- VSK;

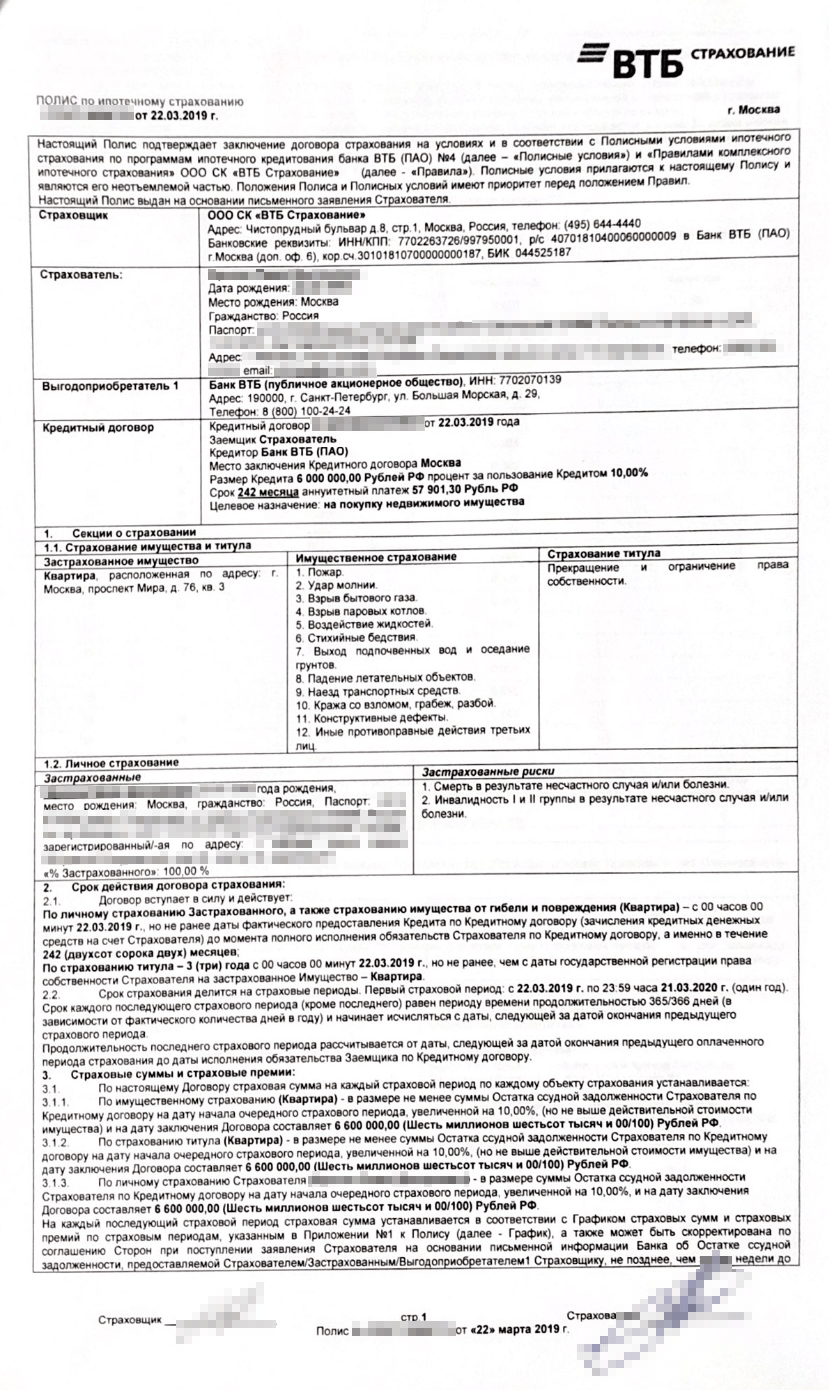

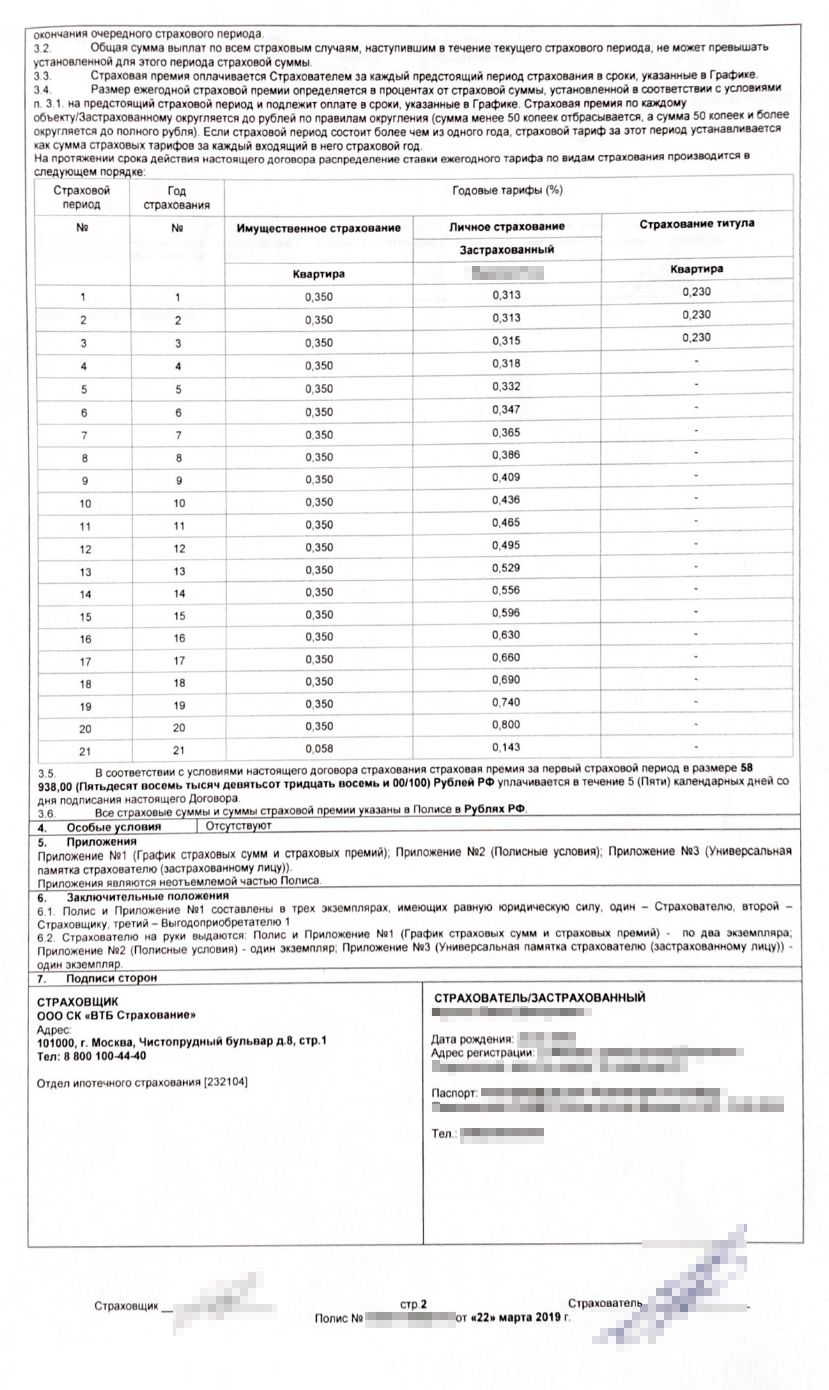

- VTB Insurance coverage;

- Grant;

- SberInsurance;

- Ingosstrakh;

- Renaissance Insurance coverage Group;

- BET;

- RESO-guarantee;

- RSB-Insurance coverage;

- Sogaz.

Corporations adjust to the obligatory necessities of Sberbank: they’re formally registered, have all permits, have been working for greater than 3 years, meet the standards for a secure monetary place, they’ve digital doc administration, and many others.

These insurers are additionally Sberbank’s life and medical health insurance companions. A whole record of accredited corporations for this kind could be seen on the hyperlink.

It’s not prohibited to take out mortgage insurance coverage in an unaccredited insurance coverage firm, solely the lender will request its authorized paperwork and can perform verification. It takes as much as 30 days, in consequence, he has the best to refuse to just accept insurance coverage.

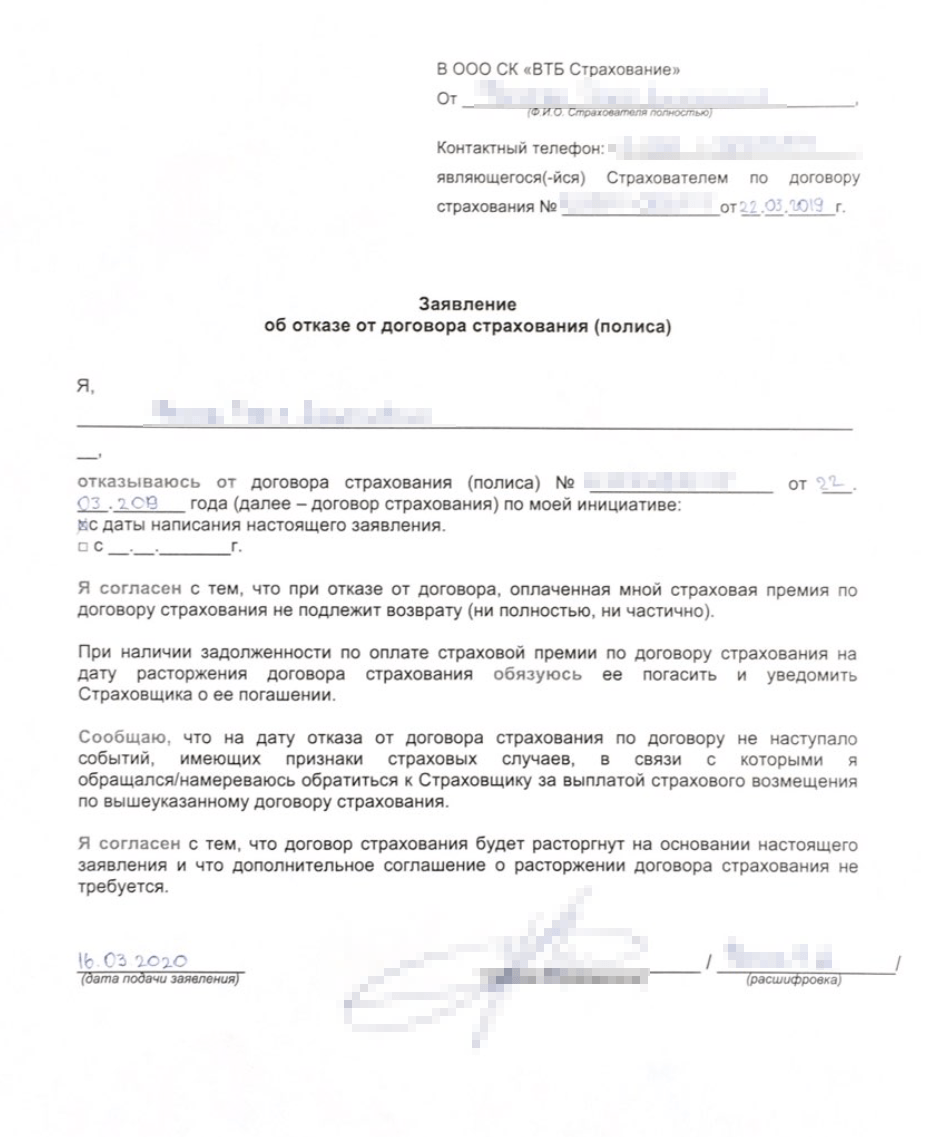

Terminate outdated insurance coverage contracts

At first, I had no intention of terminating the outdated insurance coverage contracts in any respect. However, once I wrote this text, I assumed: what in the event that they proceed to function sooner or later due to can this trigger me issues? So I known as Sberbank.

It turned out that I actually have termless contracts with Sberbank Insurance coverage, and inside their framework, annual insurance policies might be drawn up for me yearly. However since in 2020 I took out insurance coverage insurance policies in one other firm, Sberbank-Insurance coverage will unilaterally terminate the contracts with me due to non-payment of insurance coverage premiums. That’s, as well as, I shouldn’t have to do something, I’ve nothing to fret about.

But when the insurance coverage contract is concluded for your complete interval of the mortgage and there’s no situation for automated termination in it due to non-payment of the insurance coverage premium, it’s higher but terminate it your self. In any other case, the insurance coverage firm will nonetheless proceed to be liable underneath the contract, even when you don’t pay the subsequent insurance coverage premium on time.

If you don’t terminate the contract your self, then the insurance coverage firm should do it via the courts. In one of the best case, she is going to recuperate solely authorized prices from the insured, and within the worst case, the quantity of the unpaid insurance coverage premium. The courts willingly fulfill such insurance coverage claims.

I do know from expertise that circumstances can change. So, they acquired a mortgage in June 2021. And so they have a mortgage insurance coverage contract from “Sber Insurance coverage” concluded for one 12 months and terminates after the date till which the coverage is paid.

Basically, it’s higher to verify how you might be. To do that, simply name the insurance coverage firm.

To terminate the insurance coverage contract, it is sufficient to write a press release of refusal from it. This may be finished personally on the workplace of the insurance coverage firm – on this case, the appliance kind might be given on the spot. You too can ship a scanned copy of the withdrawal settlement by e-mail. To do that, you should first make clear the tackle with an worker of the insurance coverage firm and ask them to ship you an utility kind. It will not be essential to terminate the contract if, in line with its phrases, it ceases to be legitimate after the date by which the policyholder paid the premium.

How do I pay for insurance coverage?

By legislation, the financial institution just isn’t entitled to require that the borrower draw up a coverage in some a selected insurance coverage firm and insured dangers in a single group throughout your complete mortgage interval. This violates the Regulation “On Safety of Competitors”: in any case, it is best to have the best to decide on your personal insurer.

However often the mortgage supervisor even earlier than the conclusion of the contract buy and sale gives to purchase insurance coverage from a pleasant or affiliated firm. Such corporations are present in most mortgage lenders. For instance, Sberbank “Sber Insurance coverage”, at Sovcombank – “Sovkom-insurance”.

Necessities for corporations imposed by Sberbank

Sure necessities are imposed on corporations included within the record of accredited insurance coverage corporations of Sberbank, in addition to those who, though not accredited, however the borrower needs to buy a coverage from them.

They differ relying on the kind of insurance coverage:

- download official necessities for all times insurance coverage corporations;

- download claims to corporations for another kinds of insurance coverage (together with mortgage property).

The fundamental necessities for organizations offering mortgage insurance coverage are virtually the identical:

- interval of exercise – at the very least 3 years;

- obligatory provision by the corporate of non-public information about their homeowners, who’ve a share within the licensed capital of 5% or extra;

- the dearth of overdue obligations of the UK to the funds and extra-budgetary funds;

- the absence of an unexpunged or excellent conviction from the leaders or shareholders of an insurance coverage firm with a share within the licensed capital of 5% or extra;

- accredited and non-accredited insurance coverage corporations have a monetary power ranking assigned by one of many ranking businesses – S&P International Rankings, Fitch Rankings, Skilled RA, ACRA, and many others.;

- the ranking should not be decrease than the established stage (for instance, not lower than ruA+ in line with the nationwide scale Skilled RA);

- compliance of the insurance coverage with indicators of economic stability (debt burden, unprofitability, return on capital, present solvency, enterprise exercise indicator, and many others.).

Along with the above necessities, insurance coverage corporations from the record of life insurance coverage corporations accredited by Sberbank for Sberbank mortgages or different kinds of insurance coverage should enter into contracts with clients on sure circumstances.

For instance, mortgage insurance coverage agreements should meet the next necessities:

- the presence of the total title, postal tackle, e-mail tackle of the Sberbank division that issued the mortgage, the variety of the mortgage settlement, a sign that the insured property is pledged;

- the beneficiary should be the financial institution – in a part of the debt on the mortgage, within the half exceeding this quantity – the insured;

- the contracts should present for a situation on the non-use of incomplete property insurance coverage (Article 949 of the Civil Code of the Russian Federation), and many others.

How to decide on the best insurance coverage for a mortgage: ranking

Most mortgage debtors in selecting an insurance coverage firm are guided by the minimal value for the companies provided. Nonetheless, the reliability of the insurer, making an allowance for its monetary stability and a very powerful financial indicators, remains to be of no small significance.

In keeping with the Russian ranking company Skilled RA in 2023, essentially the most dependable insurance coverage corporations authorized for mortgages and accredited by Sberbank included (ranging from the best):

- SOGAZ

- Ingosstrakh

- VTB Insurance coverage

- Sberbank Insurance coverage

- YAG

- AlphaInsurance

- Liberty Insurance coverage

- RESO Assure

- RSHB-Insurance coverage

- VSK

- Energoguarantor

SOGAZ, Ingosstrakh and VTB Insurance coverage corporations are characterised by most creditworthiness and monetary stability. The forecast for his or her actions within the Russian market is secure.

Comparability of accredited insurance coverage corporations for insuring Sberbank debtors

An insurance coverage firm from Sberbank, which insures primarily its debtors. A dependable firm trusted by many shoppers.

- Ease of registration for Sberbank debtors

- Stability

- Insurance coverage charges are among the many highest out there

A well known insurance coverage firm that has been working out there for a very long time. Reliability ranking AA + “excessive stage of economic reliability”.

- Among the finest charges

- Extra reductions

- Not the most important charges

A big insurance coverage firm, a subsidiary of Alfa Financial institution, ranks 2nd when it comes to charges.

- Favorable charges

- Extra reductions

- Require medical affirmation for mortgage life insurance coverage virtually all the time

A preferred and well-known insurance coverage firm has been working out there for a very long time. Excessive stage of reliability.

- Insures debtors over 60

- Monetary stability

- Unpredictable pricing

One of many largest insurance coverage corporations in Russia. The AAA reliability ranking is the best.

- Paying firm

- Many workplaces

- Excessive charges for feminine debtors

Accredited insurers for all times and medical health insurance of a mortgage borrower

Completely the identical insurance coverage corporations that difficulty property insurance coverage (listed above) take part in well being and life insurance coverage for a shopper making use of for a mortgage at Sberbank.

With nearly all of accredited mortgage insurance coverage organizations, Sberbank has entered right into a cooperation settlement that enables it to resolve rising points and issues, in addition to conclude contracts with clients in an accelerated and extra loyal mode. Plenty of corporations, within the presence of such an settlement, present reductions to Sberbank clients. On the identical time, every insurer gives its personal, distinctive circumstances for cooperation with debtors.

The lists of accredited mortgage insurance coverage corporations of Sberbank are always altering. You possibly can observe up-to-date info on the lender’s web site or with us. To do that, subscribe to the location replace.

The place is one of the best place to purchase a coverage?

It’s most worthwhile to calculate the fee for all insurance coverage corporations, it’ll assist on this mortgage insurance calculator. Mortgage is obtainable solely with insurance coverage. Immediately, many organizations are prepared to hold out insurance coverage. Property insurance coverage, life will certainly get a mortgage.

An organization that has been working within the insurance coverage market for a very long time can supply it on favorable phrases. It’s best to conclude an insurance coverage contract with organizations equivalent to Renaissance, Alfa Insurance coverage, Yugoria.

Insurance coverage is a assure for the lender that the borrower will fulfill his obligations.