Materials content material

Test your rate of interest

When selecting a financial institution to purchase actual property with a mortgage, probably the most necessary components for a consumer is the rate of interest on the mortgage. In Sberbank, charges have reached a historic minimal – for instance, you should buy a brand new constructing with a fee of 0.1% in partnership with developers.

Discover out about all packages and promotions that mean you can scale back the speed: “How to get a discount on the rate when applying for a mortgage”. Ensure you use each alternative to decrease your fee.

Along with the rate of interest in your mortgage, on the primary web page of the contract, in a sq. body, one other fee is indicated in a well-readable font. It’s larger than the speed for this system you’ve got chosen. We are going to discuss it beneath.

We submit paperwork to the financial institution

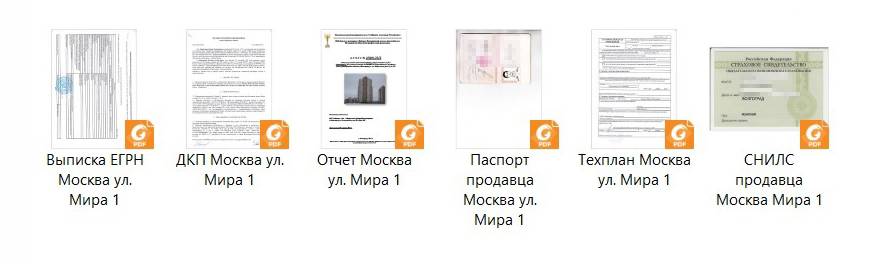

Often copies are sufficient for the financial institution, the originals must be introduced just for the transaction. There are particular suggestions on how to attract up a package deal of paperwork:

- Scanned copies and pictures ought to be of fine high quality, and the data ought to be simple to learn. The quantity, or weight, of the information is as small as attainable.

- Information in PDF or JPEG format. If one doc accommodates a number of pages, for instance, a vendor’s passport, then it’s higher to difficulty it in a multi-page PDF format.

- Information ought to be named in accordance with their content material. For instance, a technical passport, an extract from the USRN, and so forth. It’s fascinating so as to add the tackle of the thing to the file identify.

You’ll be able to ship paperwork to the financial institution:

- By e mail.

- With the assistance of Web providers, whether it is carried out within the financial institution.

- Personally, carry it to the financial institution department.

When contacting in individual, moreover verify with the supervisor what must be offered: originals immediately or sufficient copies in good high quality. The financial institution worker will verify the copies with the originals on the transaction.

To signal a mortgage settlement and a sale and buy settlement, you’ll want to present the financial institution with the paperwork on the thing precisely within the type wherein you despatched them for approval of the thing. It occurs that the vendor offered a replica of the passport, and in the course of the time the financial institution was contemplating the thing, his registration modified. If the financial institution supervisor finds a discrepancy within the paperwork on the transaction, he can ship an software for revision. This takes time, and usually the transaction should be rescheduled for an additional day. To get rid of this example, ask the vendor to right away present the amended paperwork. If modified any doc, you’ll want to ship it to the financial institution within the appropriate type at the very least a day earlier than the transaction.

It’s fascinating to offer a package deal of paperwork for object approval in its entirety directly. It will velocity up the assessment course of. Exceptions are the evaluation report and paperwork on the achievement of suspensive situations. Appraisers submit the appraisal report back to most banks on their very own. Often, the creditor is happy with the digital model of the report. Nevertheless, if the financial institution requests a paper model, you will want to select up the unique and produce it with you to the transaction together with the remainder of the paperwork.

Suspension situations are situations after which a mortgage will be issued. An object will be accepted, however a mortgage will be issued, that’s, a deal will be made, solely given that sure paperwork are offered. These paperwork will be delivered to the financial institution immediately on the day of the transaction for the signing of the mortgage settlement. Most frequently, notarized consent, a wedding contract, a certificates of absence of registered individuals and different paperwork are requested.

Ordering an actual property appraisal report

The report describes intimately the technical traits of the thing: space, variety of rooms, variety of storeys, diploma of decay of the home, and others. The doc is required in order that the financial institution is aware of the market worth of the topic of mortgage and that whether or not there’s a redevelopment within the house.

The report is made by specialised appraisal corporations or particular person appraisers who’ve a license for this exercise. The Financial institution should settle for a valuation report from any appraiser who holds a license. In observe, many banks have a restricted checklist of organizations from which they settle for stories. Due to this fact, you’ll want to verify with the mortgage supervisor wherein group you possibly can order an evaluation report. If the checklist of appraisers is proscribed, then you’ll want to order a report from one of many accredited appraisal corporations.

Chasing the Low Fee

Take out a mortgage a low share is a key purpose, this isn’t the correct resolution. In fact, we flip to the proportion, evidently the decrease, the extra worthwhile the deal. This isn’t fully true, for the reason that mortgage borrower faces plenty of extra funds:

- insurance coverage;

- fee;

- charges of assorted varieties, and so on.

As well as, if a financial institution gives some object at a sure share, there could also be an issue within the object, this ought to be taken under consideration. Initially, you’ll want to construct on the worth of the chosen house, then take into consideration the proportion. When making use of for a mortgage, keep in mind that that is vital for the supervisor, not the consumer. The supervisor is serious about making a deal by his financial institution. When a financial institution consultant presses in and threatens to make a deal instantly, be cautious of the provide. Demand to learn the complete provide, take time to assume.

Shopping for insurance coverage

Inconsiderate registration of insurance coverage – the following mistake is quite common. Can I get a mortgage with out insurance coverage? Sure. When concluding an settlement, the financial institution usually gives to difficulty two varieties of insurance coverage:

- life;

- collateral (bought house).

By regulation, the one necessary insurance coverage is collateral insurance coverage. However, however, the financial institution, in case of refusal to difficulty life insurance coverage, will increase the proportion, thereby complicating the reimbursement of the mortgage. There’s one nuance right here, there are banking organizations that abuse the state of affairs and overly impose unfavorable insurance coverage situations on folks. It’s attainable that just one insurance coverage possibility is offered and there’s no point out of the existence of another resolution.

There’s all the time another, and as a rule, the choice provided by the financial institution on the spot is probably the most disadvantageous possibility. Every financial institution has an inventory of 10-15 accredited insurance coverage corporations, and the consumer has the correct to make use of the providers of one in every of them. It’s essential to take the contacts of those corporations and discover out the settlement insurance policies relying on the state of affairs:

- ground;

- age;

- well being standing.

Then you’ll want to select the most cost effective possibility, as a result of even when there may be an insured occasion, the consumer and relations is not going to obtain cash.

Stage V: settlements with the vendor

The switch of cash to the vendor, as a rule, happens by putting the client’s personal and credit score funds in a financial institution cell. This occurs within the presence of a financial institution worker.

The vendor attracts up a receipt for the receipt of funds in full and retains it till the registration of possession of the house within the identify of the client.

The situation for opening a secure deposit field would be the submission to the financial institution of a contract for the sale of an house with a mark of Rosreestr on registration of possession or an extract from the USRN, wherein the client is indicated because the proprietor of the property, and a mortgage is established as an encumbrance.

In relation to the mortgage of residential premises, an accelerated registration interval is offered – 5 working days from the date of submission of the mandatory paperwork to Rosreestr, when making use of by the middle of state and municipal providers “My Paperwork” – 7 working days. If the contract is notarized, the interval is diminished to three and 5 enterprise days, respectively.

Can they deprive them of their solely dwelling?

Mortgagers will be disadvantaged of their solely housing. In spite of everything, a mortgage supplies for a pledge of actual property, comparable to an house, which signifies that it may be withdrawn if there’s a delay on the mortgage. In observe, they’re usually evicted from the one housing even within the occasion of a slight delay (in comparison with the mortgage quantity), if it was lengthy. On the identical time, the length of the delay is an element that every financial institution determines independently.

Eviction takes place on the idea of a courtroom determination. And even the residence of minors in an house is taken into account by the courtroom solely as a floor stopping eviction. Principally, it should take into consideration the truth that debtors had been obliged to pay on a mortgage mortgage, however didn’t fulfill their obligations. Due to this fact, the financial institution has the correct to demand termination of the mortgage settlement and foreclosures on the house.

Within the case when they’re evicted from the one housing, residents should urgently apply to the division of social safety as a way to affirm the standing of a low-income household. You’ll want to focus not solely on the low stage of revenue, but in addition on the absence of the principle place of residence. Such purposes are sometimes accepted, and residents obtain public housing or a room in a hostel.

Paperwork for registration of a mortgage for secondary housing

Having realized the accepted quantity, selecting an appropriate dependable housing, you possibly can accumulate paperwork for signing the contract and put together for the acquisition.

Borrower’s paperwork

- Passport of the borrower (all pages);

- Licensed copy of labor;

- Questionnaire;

- Partner’s consent (if any);

- Approval of guardianship authorities (if any).

Paperwork for an house or home

- Certificates of possession of the earlier proprietor;

- Extract from the USRN;

- A certificates that lists all individuals residing at this facility;

- Report available on the market worth of the dwelling.

After you carry all of the paperwork, the financial institution will verify them and provide for registration:

- Contract of sale;

- Mortgage;

- mortgage settlement;

- Assure settlement (signed by the co-borrower);

- Insurance coverage contract.

What’s included within the mortgage settlement

Here’s a guidelines of what you need to take note of when signing a contract:

- what are the situations for termination beneath totally different circumstances;

- is there an possibility to vary the phrases of the contract, and unilaterally;

- is it attainable to repay the mortgage forward of schedule and what are the situations;

- what sort of fee – floating or fastened;

- what penalties and fines are offered for non-payment on time;

- what cost format – annuity (when your entire quantity is split into equal elements and paid month-to-month) or differentiated (you additionally must pay a set quantity of debt and curiosity on the excellent half each month).

What the regulation says

Banks can create their very own fashions of mortgage agreements, however they need to all adjust to the regulation. Mortgage regulation in Russia FZ-102, article 9 which explains what should be included within the contract. In complete, the regulation defines 6 necessary factors:

- The doc should point out the topic of the mortgage, its evaluation, the time period for the return of funds.

- Description of the topic of the mortgage, that’s, the actual property bought and pledged, its location.

- The results of actual property appraisal, which is necessary for all transactions.

- A full description of the duty, indicating the quantity and cause for the prevalence.

- The timing and frequency of creating funds to repay the mortgage.

- If a mortgage is drawn up, details about it’s indicated within the contract.

The mortgage course of

- We select the perfect provide from the financial institution: we take a look at rates of interest, we analyze choices from numerous official lenders.

- We estimate extra prices: cost of state responsibility, providers of a housing appraiser, insurance property.

- We select actual property. It’s higher to not delay, in any other case the situations of the financial institution might change, and you’ll have to return to level 1.

- We accumulate a package deal of paperwork, specifically:

- borrower’s passport;

- a replica of the work e-book;

- cadastral and technical passports for actual property;

- revenue assertion;

- vendor’s passport;

- a doc that confirms the vendor’s possession of the property;

- actual property appraisal report.

What ought to be included in a mortgage settlement

Every financial institution or monetary establishment independently decides what the mortgage settlement appears to be like like. However the Mortgage Regulation FZ-102 protects the pursuits of debtors and explains intimately the foundations for acquiring such a mortgage. The content material of the contract is described intimately in article 9. The doc should point out:

- actual particulars of the borrower and lender;

- a complete description of the topic of the mortgage – the tackle of the thing, identify, space, variety of rooms, availability of engineering networks, phrases of commissioning;

- complete mortgage quantity, time period of the settlement, rate of interest, quantity and schedule of funds;

- situations for the complete reimbursement of the mortgage;

- the worth of the collateral, and it’s permissible to contain specialists within the evaluation;

- obligations of the borrower;

- Borrower’s rights – situations for coping with collateralized actual property, the correct to reside or in any other case use.

The rights of the borrower to the property are confirmed not by a mortgage mortgage settlement, however by a mortgage. This can be a separate doc within the contract.