Materials content material

Further insurance coverage

How are you going to save

Nevertheless it turned out that I can save on insurance coverage. To do that, it is sufficient to change the insurance coverage. I came upon about this accidentally: I used to be sitting in line on the financial institution, and the lady subsequent to me shared this data with me. She even gave me a enterprise card with the telephone variety of the insurer.

I made a decision to name and discover out the small print. The insurance coverage supervisor made an approximate calculation. Financial savings on two insurances was about 1500 R. The following day I referred to as the financial institution. It turned out that the financial institution’s web site has lists of accredited insurance coverage firms – I might select any and conclude an settlement with it.

To grasp how a lot I can save and the way a lot insurance coverage costs differ, I went to in the mortgage lending section of the website “Banks-ru“. The stability of the debt on my mortgage was 700,000 R. The result’s this image:

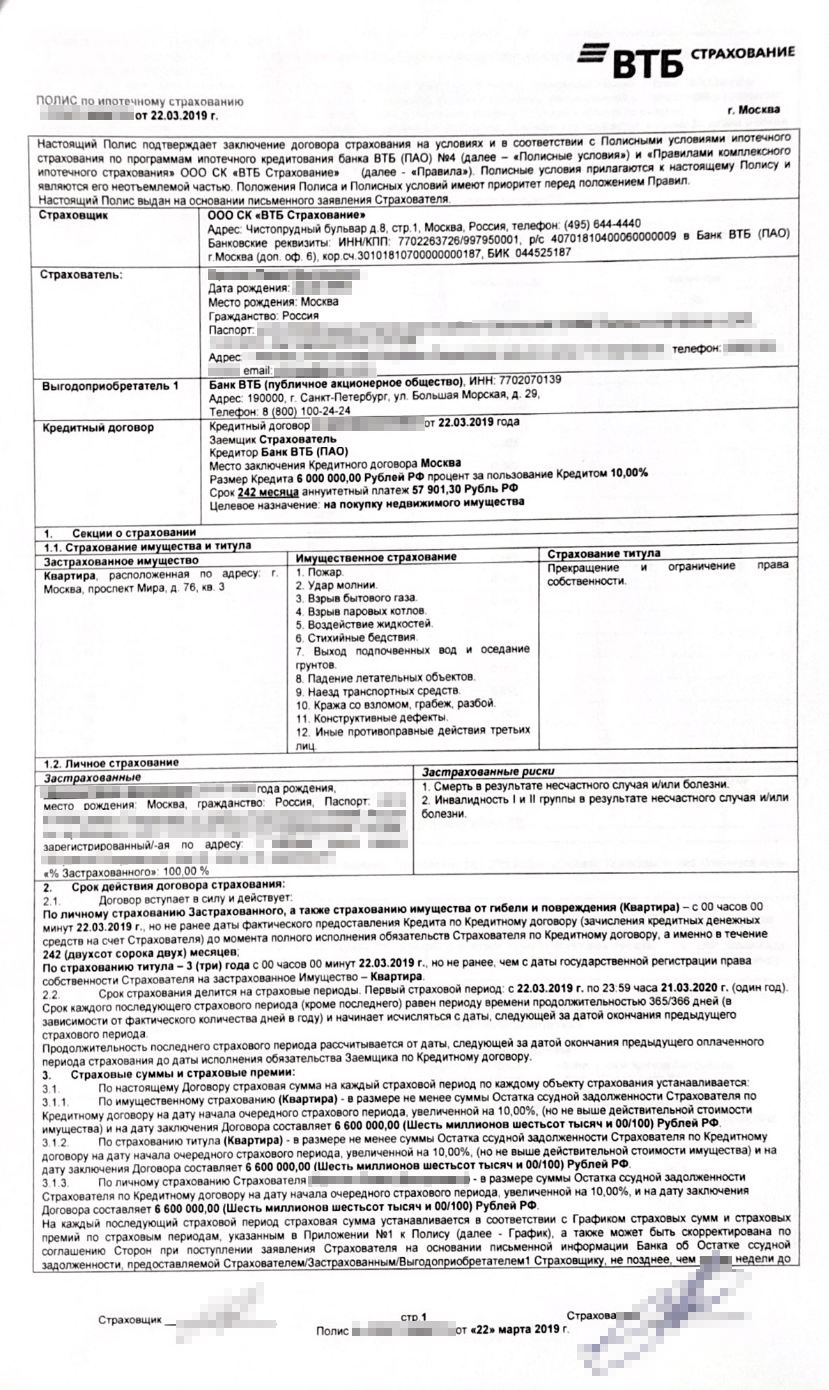

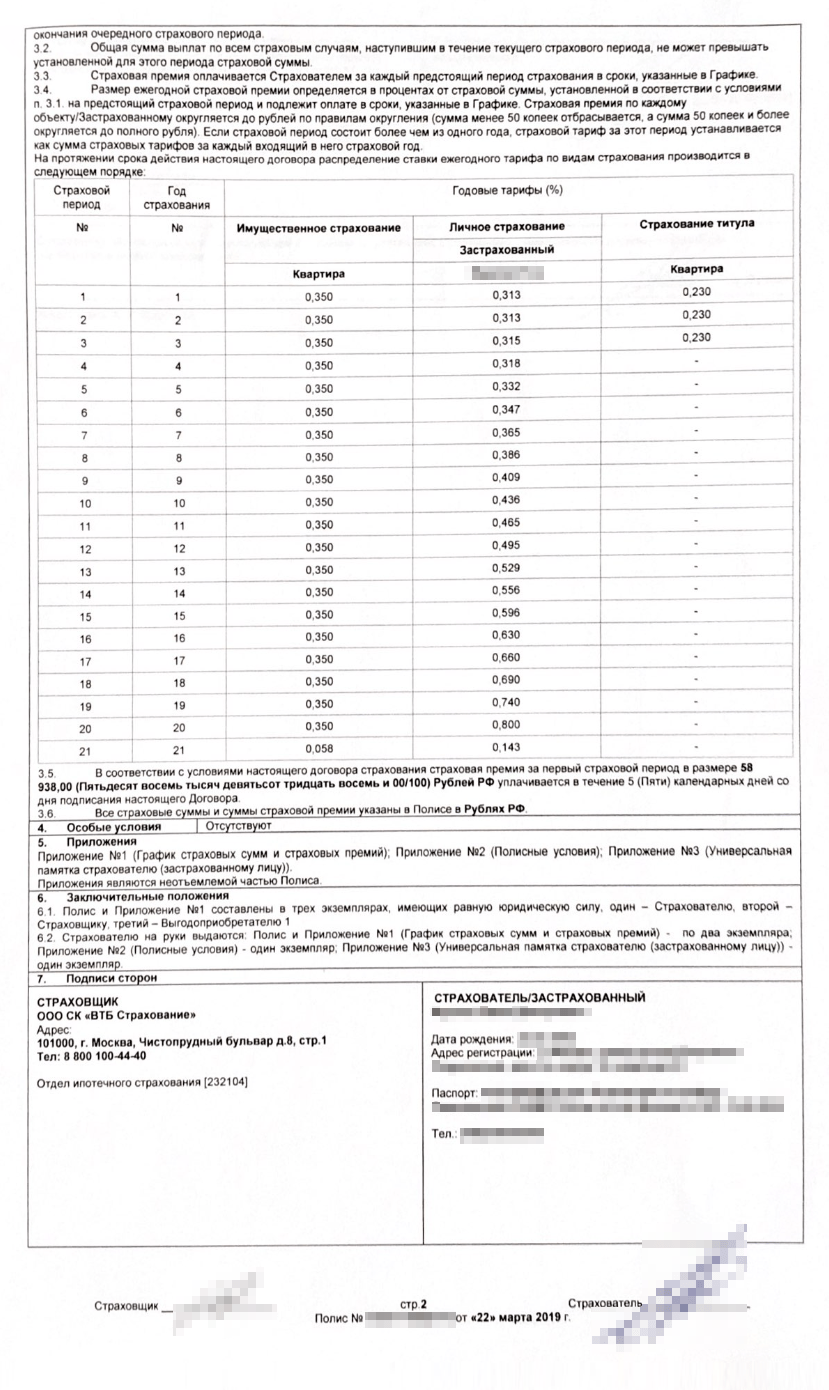

- V “VTB Insurance coverage” I would pay 4088 R: 1610 R for property insurance coverage and 2478 R for all times and medical insurance;

- in VSK – 3535 R: 1155 R for property insurance coverage and 2380 R for all times and medical insurance;

- in Zetta – 3076.5 R: 1046.5 R value of property insurance coverage, 2030 R – life and medical insurance.

These should not all obtainable insurance coverage firms, however solely an instance. It was apparent that it was helpful for me to alter insurance coverage. So I did.

An insurance coverage dealer can select the very best insurance coverage choice. It is free, because the insurance coverage firm pays the fee.

It’s not essential to register all dangers in a single firm. For instance, you’ll be able to insure life and well being in Zetta, and property in “Alpha Insurance coverage” if the speed is decrease. It is crucial that each insurance coverage firms are accredited by the financial institution.

Right here is the algorithm I adopted:

- Discovered a listing of insurance coverage firms accredited by the financial institution, for instance Sberbank has more than 20 of them.

- I selected insurance coverage and calculated the approximate value of insurance coverage.

- Collected the paperwork which might be wanted to attract up insurance coverage contracts.

- Issued new insurance coverage insurance policies.

- Terminated previous insurance coverage contracts.

- Despatched new insurance policies to the financial institution.

I am going to inform you extra about all of the steps.

What mortgage insurance coverage is required

The laws establishes the compulsory nature of an insurance coverage coverage for a mortgage mortgage object, i.e. for an house being bought or already owned by the borrower, in a single – from emergencies (Article 31, paragraph 2 of the Legislation No. 102-FZ “On Mortgage”). This insurance coverage will enable the borrower to all of a sudden not be left homeless and with mortgage funds for 10 years.

Observe that the situations for the insurer to take over the debt obligations of the borrower within the occasion of an insured occasion are entered into the contract individually. Most frequently, when defending residential actual property, insured occasions point out:

- pure disasters (hearth, lightning strike, and many others.);

- accidents on engineering communications (explosion of home fuel, flooding, and many others.);

- unlawful actions of third events dedicated in violation of the regulation (hooliganism, vandalism, theft, and many others.).

Different kinds of mortgage insurance coverage, equivalent to lack of title insurance coverage and life insurance coverage with the well being of the recipient of the mortgage – non-compulsory. These. you’ll be able to refuse. Nevertheless, their registration, quite the opposite, might change into a profit for the shopper of the mortgage financial institution (see beneath).

Terminate previous insurance coverage contracts

At first, I had no intention of terminating the previous insurance coverage contracts in any respect. However, after I wrote this text, I assumed: what in the event that they proceed to function sooner or later due to can this trigger me issues? So I referred to as Sberbank.

It turned out that I actually have termless contracts with Sberbank Insurance coverage, and inside their framework, annual insurance policies will likely be drawn up for me yearly. However since in 2020 I took out insurance coverage insurance policies in one other firm, Sberbank-Insurance coverage will unilaterally terminate the contracts with me due to non-payment of insurance coverage premiums. That’s, as well as, I don’t have to do something, I’ve nothing to fret about.

But when the insurance coverage contract is concluded for the whole interval of the mortgage and there’s no situation for computerized termination in it due to non-payment of the insurance coverage premium, it’s higher but terminate it your self. In any other case, the insurance coverage firm will nonetheless proceed to be liable underneath the contract, even when you don’t pay the following insurance coverage premium on time.

If you don’t terminate the contract your self, then the insurance coverage firm must do it by means of the courts. In the very best case, she’s going to get better solely authorized prices from the insured, and within the worst case, the quantity of the unpaid insurance coverage premium. The courts willingly fulfill such insurance coverage claims.

I do know from expertise that situations can change. So, they acquired a mortgage in June 2021. They usually have a mortgage insurance coverage contract from “Sber Insurance coverage” concluded for one 12 months and terminates after the date till which the coverage is paid.

Generally, it’s higher to examine how you might be. To do that, simply name the insurance coverage firm.

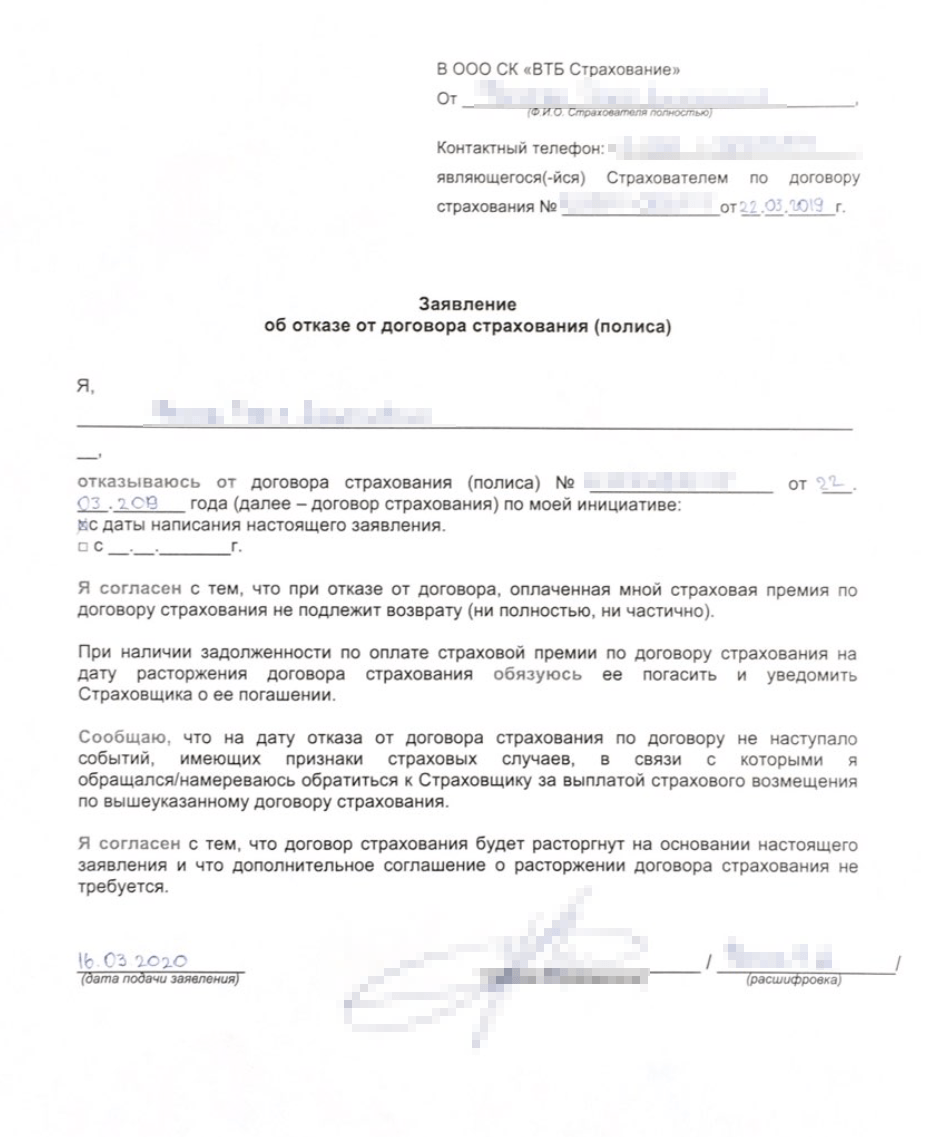

To terminate the insurance coverage contract, it is sufficient to write an announcement of refusal from it. This may be executed personally on the workplace of the insurance coverage firm – on this case, the appliance type will likely be given on the spot. You can even ship a scanned copy of the withdrawal settlement by e-mail. To do that, it’s essential to first make clear the deal with with an worker of the insurance coverage firm and ask them to ship you an software type. It is probably not essential to terminate the contract if, in line with its phrases, it ceases to be legitimate after the date by which the policyholder paid the premium.

How to save cash on shopping for mortgage insurance coverage?

When you comply with some guidelines, it can save you so much when shopping for insurance coverage. We have put collectively some ideas for affordable mortgage insurance coverage. By adhering to them when acquiring a mortgage or shopping for a coverage, it can save you cash and buy essentially the most worthwhile coverage.

1 Make the borrower a lady, because the charges for girls’s insurance coverage are a lot decrease

2 Don’t purchase insurance coverage on the financial institution itself. Insurance coverage firms will make you a greater supply

3 Change the insurance coverage firm. Rivals give important reductions when switching

4 Use the companies of an insurance coverage dealer, as we are going to calculate the whole lot for you and supply the very best costs, in addition to make a reduction.

5 Get a private earnings tax refund. Make a tax deduction within the type of 13% of the price of the coverage.

To search out out the precise value of an affordable mortgage coverage in all insurance coverage firms, please contact our managers for a free session. They may make you a calculation for essentially the most advantageous presents Depart a request

Mortgage insurance coverage

When you resolve to make use of a mortgage mortgage to buy actual property, then one of many compulsory situations for acquiring a mortgage from a financial institution is the conclusion of an insurance coverage contract. We’re prepared that will help you select the very best complete mortgage insurance coverage applications from main insurance coverage firms, bearing in mind the usual necessities of most creditor banks. Consideration! In case you are already insured for a mortgage, however are in search of a dependable insurance coverage firm with decrease charges for the following 12 months of insurance coverage – examine the charges of the present coverage with the charges of different insurance coverage firms, our service will enable you! Mortgage insurance coverage coverage is a assure of the achievement of the borrower’s obligations to repay the acquired mortgage!

FAQ

The place can I discover a listing of accredited insurance coverage firms? The listing of insurance coverage firms that meet the necessities of the creditor financial institution will be discovered on the financial institution’s web site or clarified by telephone on the financial institution department itself. What’s the listing of required paperwork for concluding an insurance coverage contract? The listing of required paperwork is determined by the necessities of the insurance coverage firm and the dangers accepted for insurance coverage. Our specialist sends the whole listing of required paperwork together with the calculation of the price of the insurance coverage coverage. In what instances is a medical examination required for all times and medical insurance of the borrower? The necessity for a medical examination is established for every shopper individually, and is determined by the quantity of the sum insured and the age of the borrower, in addition to on the details about the state of well being specified within the software type. Individuals who’ve reached the age of 65 and above, on the time of conclusion of the insurance coverage contract, can’t conclude an insurance coverage contract, whatever the above components. What’s the period of the mortgage insurance coverage settlement? The mortgage insurance coverage settlement is concluded for one 12 months or for the whole time period of the mortgage settlement with annual renewal. The time period of the coverage is set by the necessities of the lender. The time period of the mortgage insurance coverage settlement for Sberbank clients is 12 months. How is the insurance coverage premium paid? When concluding an insurance coverage contract for a interval of 1 12 months, the insurance coverage premium is paid in a lump sum or in installments (as agreed with the financial institution). If the contract is concluded for a interval of multiple 12 months, the insurance coverage premium is paid yearly in the course of the time period of the insurance coverage contract. Within the occasion of an insured occasion, who will obtain the insurance coverage compensation?