Materials content material

Advantages of a greenback mortgage

The primary benefit of a overseas forex mortgage is a small nominal fee, which differs from the speed in Russian rubles. Here is a median instance:

- Greenback mortgage at a fee of about 8.5%

- In Russian rubles – not more than 12%

Let’s do a easy calculation. Based on the Financial institution of Russia, residents typically take out a mortgage for not more than 7 years, its quantity doesn’t exceed 4 million rubles. If we take a mortgage in {dollars} at 8.5% for 7 years, then the overpayment might be 1,236,968 rubles.

If we take the identical quantity for a similar period of time in rubles at 11.5% every year, then the financial institution curiosity might be 1,753,139 rubles. The distinction is half 1,000,000, 516,171 rubles. It seems {that a} overseas forex mortgage is extra worthwhile, however solely when the greenback alternate fee stays unchanged for all seven years.

Professionals and cons of mortgages in overseas forex

Normally, mortgage loans are for a long run. Due to this fact, a borrower planning to acquire a overseas forex mortgage ought to all the time bear in mind the attainable dangers related to fluctuations in alternate charges, that are fairly probably on the horizon of 10-15 years, whereas the mortgage is being paid.

In the course of the disaster of 2014-2016, the greenback and the euro doubled. The least losses have been incurred by debtors who obtained salaries in overseas forex, or those that, when making use of for a mortgage, used a differentiated cost schedule, which decreased with every cost. The money owed of different residents have elevated considerably.

Residents took overseas forex mortgages due to the extra favorable circumstances of banks. As a rule, the overseas forex mortgage fee was an order of magnitude decrease, and the overseas forex was extra secure.

Mortgage refinancing

Many voters are confronted with refinancing – the switch of mortgages into rubles, if earlier it was taken in {dollars}. This course of has apparent benefits:

- Lowering month-to-month funds

- If the debt is small or non-existent, the prospect of repaying the mortgage as quickly as attainable will increase

- One of many attainable choices that exclude the lack of actual property

Cons of refinancing:

- If the alternate fee rises, the debt could rise as nicely.

- Lending charges might go up

- When reissuing a mortgage, extra prices could seem within the type of insurance coverage, and many others.

For the borrower, all refinancing issues are solved purely individually. Deferrals on funds, credit score holidays may be actual measures for the borrower. If the consumer is fortunate, banks will meet midway and assist discover a method out of this case.

The motion of overseas alternate mortgages

By the top of 2014, the expansion of the euro and the greenback reached its climax. On the identical time, forex mortgage lenders created a public motion to attract the eye of the authorities to the present troublesome scenario. The members within the motion put ahead a particular proposal – the adoption of a legislation in keeping with which banks should convert the steadiness of the debt into rubles on the fee on the time of registration of the overseas forex mortgage.

The Society held quite a lot of pickets. We despatched official appeals to the administration of Sberbank OJSC, to the administration of President Putin, to the Prosecutor Normal’s Workplace, the Investigative Committee and the Federal Safety Service.

The enchantment resulted within the suggestion of the Central Financial institution of the Russian Federation on recalculation on the alternate fee for November 2014. Then the greenback alternate fee towards the ruble diverse within the area of 38-40 rubles. Nonetheless, the banks agreed to partially meet the debtors: the recalculation was carried out, however on the precise fee – from 60 to 70 rubles.

The issue of debtors remained unresolved. The overwhelming majority refused to additional repay funds. There was a wave of lawsuits, the place solely banks received. Bought sq. meters legally turned the property of economic establishments.

Is it attainable to transform overseas forex mortgages?

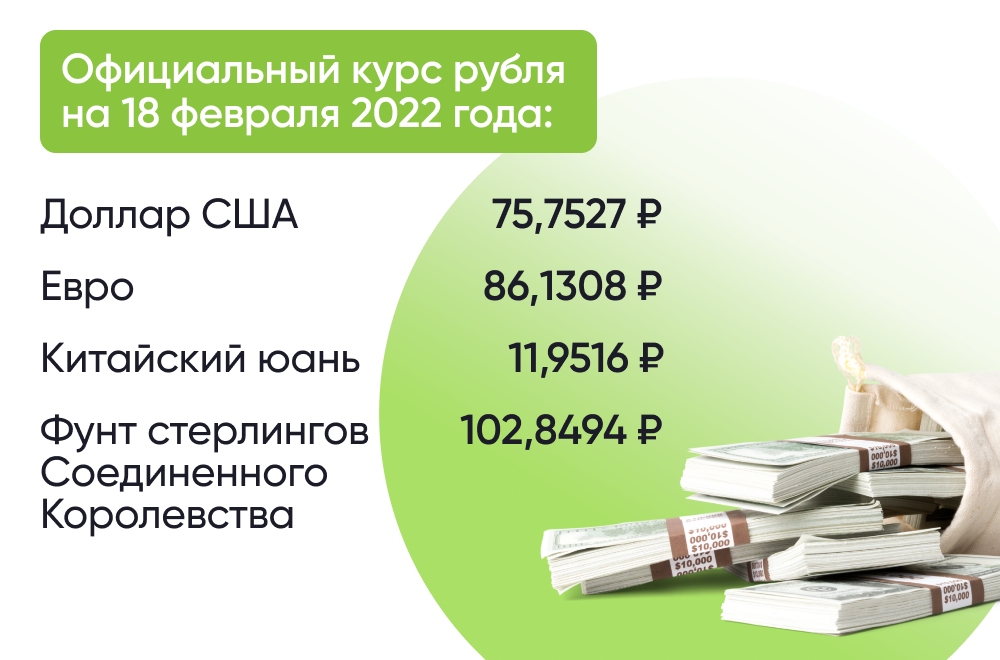

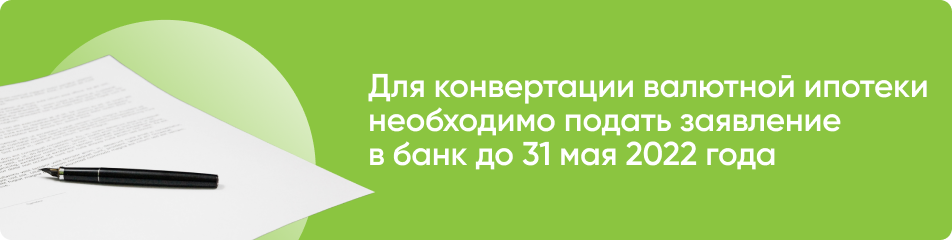

In March 2022, the Central Financial institution issued suggestions to banks to transform overseas forex mortgages concluded earlier than February 22, 2022 into rubles on the official alternate fee as of February 18, 2022.

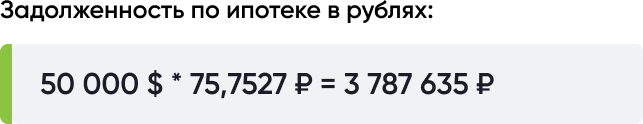

For instance, when you repay a overseas forex mortgage and your debt is $50,000, the financial institution will recalculate the mortgage into rubles. The debt might be equal to three,787,635 rubles.

To start with, debtors can apply to creditor banks, for whose loans the next circumstances are met:

- The steadiness of the debt underneath the settlement as of February 1, 2022 didn’t exceed 150 thousand US {dollars} or an equal quantity in one other forex;

- The mortgage was issued till February 22, 2022 for the acquisition of residential premises, this housing is the one one owned by the borrower in Russia;

- Overdue debt on the time of the borrower’s software doesn’t exceed 120 days.

Place of banks

Based on monetary specialists, the necessities of debtors and even authorities intervention infringes on the rights of economic establishments. As you already know, credit score funds are shaped from the cash of depositors. The financial institution is accountable to them. If the banks comply with adjust to the debtors’ necessities and the federal government’s suggestions, they must cowl the misplaced income from deposit reserves. And this entails a rise in rates of interest on loans or a lower in rates of interest on deposits, which is extraordinarily unprofitable for them.

Towards the backdrop of a few years of battles, there are additionally precedent circumstances. In March 2017, a VTB-24 consumer managed to return a mortgage residence already bought by the financial institution. As well as, the court docket ordered to bear materials duty in relation to a bona fide purchaser and bailiffs.