Materials content material

Irina, Moscow

I took a international forex mortgage in 2008. In Moscow (by this time) she and her husband had been dwelling for six years – and on a regular basis they rented flats, plus they obtained citizenship. We got here from Crimea. After acquiring citizenship, the difficulty arose with registration, and the landlady of the condominium (after our persuasion) determined to register us at her place, however with the situation of instant re-registration at her request. It was a raffle, we had nowhere to take a look at. One “stunning” day, we’re instructed that we should be discharged, the truth is – there is no such thing as a manner to do that someplace, Russian residents are solely 2 years previous. There’s cash, however not enormous sufficient to purchase an condominium even within the farthest suburbs. On TV clip after video in regards to the availability of mortgages. We determined to strive. However so as to not gather all the mandatory papers ourselves, we turned to a mortgage dealer, who picked up a financial institution and a possible (by these requirements) mortgage for us. The mortgage was $ 145,000, it needed to be repaid for 15 years, at $ 1,560 monthly. On the time of the mortgage, the quantity was as much as 40,000 rubles, with a complete wage of 80,000 rubles together with her husband, this was a possible burden.

In 2009, my husband misplaced his job, and I utilized to the Company for Restructuring Dwelling Mortgage Loans. They modified the situations and phrases of fee for me, growing the month-to-month funds for the remaining interval by 5,000 rubles. I lived in peace.

And in 2014, when the ruble started to depreciate earlier than our eyes, my fee greater than doubled. However wages haven’t gone up the identical manner. For six years and eight months, we paid the financial institution $41,000.

The debt at as we speak’s fee is just enormous – it’s approaching 7,000,000 rubles. However I didn’t take these hundreds of thousands within the financial institution! How can I give them away? Representatives of the financial institution reply all my statements, conferences and letters that they can not assist me in any manner. The response obtained to the letters that I despatched to varied authorities can also be not comforting – you signed the contract and should your self be chargeable for these dangers. However sorry! I’m not an professional, I can not predict that the ruble will depreciate a lot in six months. Why does the financial institution not wish to share this diploma of duty with me? Why are we left alone with this drawback?

No cash, no housing. What to do if there’s nothing to pay for the mortgage. Learn extra>>

https://www.youtube.com/watch?v=oAFZNH6Fpig

Execs and cons of mortgages in international forex

Usually, mortgage loans are for a long run. Due to this fact, a borrower planning to acquire a international forex mortgage ought to all the time take note of the potential dangers related to fluctuations in trade charges, that are fairly doubtless on the horizon of 10-15 years, whereas the mortgage is being paid.

In the course of the disaster of 2014-2016, the greenback and the euro doubled. The least losses had been incurred by debtors who obtained salaries in international forex, or those that, when making use of for a mortgage, used a differentiated fee schedule, which decreased with every fee. The money owed of different residents have elevated considerably.

Residents took international forex mortgages due to the extra favorable situations of banks. As a rule, the international forex mortgage fee was an order of magnitude decrease, and the international forex was extra steady.

First disaster

Earlier than the disaster of 2008, I had little question in any respect that I used to be doing all the things proper. And in November-December, the truth is, there have been no actual issues: everybody within the trade bought nervous, layoffs started, however each of my employers paid commonly. Earlier than the brand new yr, 2009, in January, each minimize their salaries (the identical quick month, off-season), and in February, one after the opposite, they refused to cooperate. Someway, by April, I bought a job in an organization with my pals – additionally they fired their PR supervisor, however then they determined to tackle a brand new one (at a wage twice as low).

Associated supplies:

“These are actual slave homeowners” 1000’s of Russians turned hostages of banks. Some handle to flee June 28, 2018

By that point, I already had a critical delay: if in January 2009 I nonetheless discovered cash for the fee, then in February-March they merely didn’t exist. It was a critical check for the nerves: at first, the telephone was minimize off by workers of the financial institution’s restoration division, then they related both collectors or “safety guards” – threats got here, they left inscriptions on the entrance door, minimize the upholstery, some individuals sat underneath the door. As quickly as I discovered a job, I bought the automotive for subsequent to nothing, and paid off my money owed. Why did not you do it instantly? In all probability, the shock affected – after the reductions, I in all probability didn’t depart the home for a month, I didn’t let my pals and oldsters in. Misplaced 15 kilos, in all probability. This, by the best way, is the one plus from the then scenario – for those who got down to discover them in any case. Earlier than that, I had been obese for years, all the time on diets.

Then, for about six months, I lived from hand to mouth – I rapidly ate the remainder of the cash from the sale of the automotive, and the earnings had been barely sufficient for the month-to-month fee, which then grew by nearly a 3rd with the expansion of the greenback. And so they paid already in rubles. Progressively I discovered part-time jobs, however nonetheless it was one thing like churning milk into butter in order to not drown.

How a lot are you able to count on this time?

Beneath the brand new guidelines, debtors can write off 30% of the debt in rubles on the trade fee on the day of restructuring. The utmost is 1.5 million rubles.

The quantity doesn’t depend upon the variety of kids, as final time. Every participant of this system can obtain a most from the state. Even households with one baby.

For a lot of forex mortgages, this quantity nonetheless won’t save the scenario. In particular instances, it may be elevated. Troublesome conditions will probably be thought-about by a particular fee. The way it will work will probably be determined by September 1.

Irina, mom of many kids, Moscow

In 2007, I, my husband and son, in want of separate housing, bought an condominium with a complete space of 30 sq. meters with the assistance of a mortgage mortgage. I took a mortgage from my financial institution, being an worker of this financial institution (to today). It was essential to pay for 25 years in US {dollars} on the fee of roughly 26 rubles per greenback. The quantity is 117,000 US {dollars}. The month-to-month mortgage fee was $1,027. From 2007 to today, now we have paid 93442 USD.

They paid commonly, with no single delay, on time. Survived the disaster of 2008. In 2011 I bought pregnant (a long-awaited being pregnant), gave start to a daughter, in 2013 God gave us one other daughter. Accordingly, since October 2011 I’ve been on trip (both maternity or childcare). Since this yr, when the greenback started to fluctuate, I’ve already utilized to my house financial institution 4 instances with a request to restructure my mortgage on the trade fee on the date of the transaction. Naturally, 4 instances obtained a refusal. The financial institution provides restructuring on the present fee with a rise within the time period of the contract by 7 years. At the moment, my husband is the one breadwinner, now we have the one housing in Moscow, I can’t go to work: there’s nobody to depart the kids, and we will’t pull a nanny. In April 2015, my allowance for caring for a kid as much as 1.5 years expires, and accordingly, I’m left with out earnings in any respect. I formally notified my financial institution that since January 2015 I’ve not been in a position to pay on the present fee and pays on the fee of 26 rubles. I don’t relinquish my obligations. To which the financial institution despatched a proposal to restructure on the present fee with a rise within the time period. It seems that my month-to-month fee will probably be 62 thousand 792 rubles. And the quantity of the mortgage (with out making an allowance for what now we have already paid) will probably be 17 million 330 thousand 640 rubles (of which 11 million 830 thousand 640 rubles will go to the financial institution as curiosity. It seems that the financial institution, represented by the manager director, believes {that a} odnushka with a complete space of 30 meters in Moscow is price this cash?: I wrote to Putin, my letter was forwarded to the Central Financial institution, the Central Financial institution replied: accepted. And silence.

What to do as we speak for many who took a international forex mortgage? Learn extra>>

Is it potential to transform international forex mortgages?

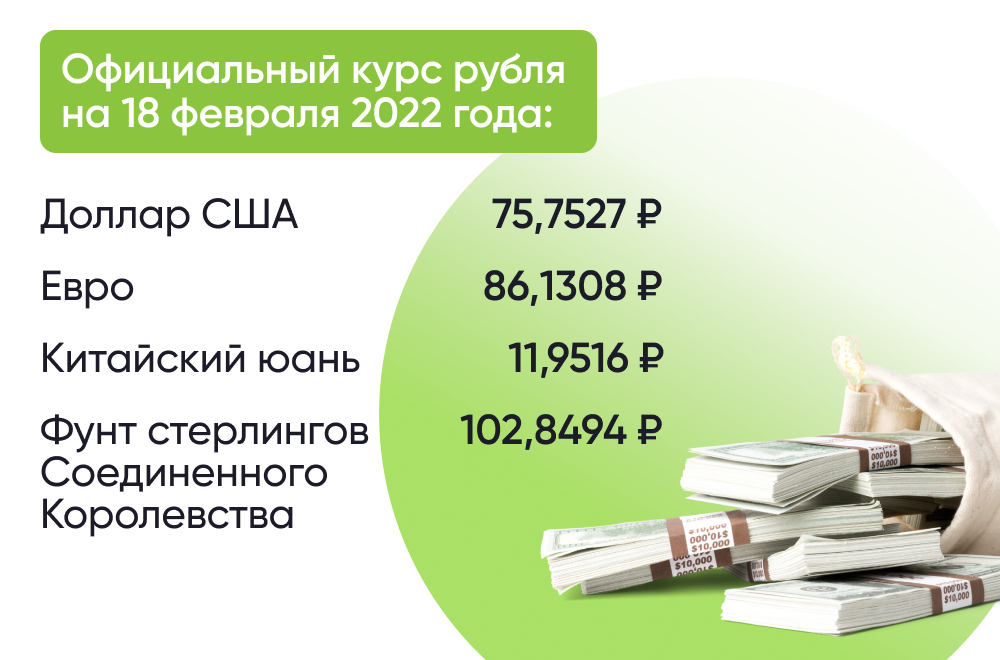

In March 2022, the Central Financial institution issued suggestions to banks to transform international forex mortgages concluded earlier than February 22, 2022 into rubles on the official trade fee as of February 18, 2022.

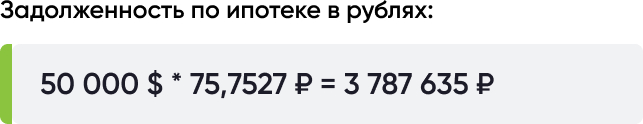

For instance, for those who repay a international forex mortgage and your debt is $50,000, the financial institution will recalculate the mortgage into rubles. The debt will probably be equal to three,787,635 rubles.

To begin with, debtors can apply to creditor banks, for whose loans the next situations are met:

- The stability of the debt underneath the settlement as of February 1, 2022 didn’t exceed 150 thousand US {dollars} or an equal quantity in one other forex;

- The mortgage was issued till February 22, 2022 for the acquisition of residential premises, this housing is the one one owned by the borrower in Russia;

- Overdue debt on the time of the borrower’s software doesn’t exceed 120 days.

I’ve a mortgage. What ought to I do now?

Fastidiously examine the brand new guidelines, don’t depend on our evaluation. For those who meet all the necessities, it is possible for you to to use for state assist on a basic foundation. If not, stay up for the committee’s choice.

Go to the financial institution. Specify what paperwork are wanted. And underneath what situations will you be given state assist. Remember to resolve the difficulty with the penalty.

Accumulate paperwork. Do not ask for further data. For instance, an extract on the one housing will not be wanted. Different data should be ordered upfront.

If it’s important to apply for a fee, take your time. Wait till they publish the place of her work, in order to not waste cash. There could also be necessities that you simply positively don’t match.

Take heed to our recommendation, however all the time keep in mind that within the case of state assist, time is cash. And solely whether or not it’s price spending cash on certificates, even when state assist might not work. However we actually need you to succeed.